This is going to hurt: SA braces for $100-per-barrel oil, diesel squeeze

As SA motorists brace for a hefty hike in fuel prices next week, the outlook for further increases is predictably murky.

As SA motorists brace for a hefty hike in fuel prices next week, the outlook for further increases is predictably murky.

The consensus is that oil prices are unlikely to breach the dreaded $100 mark, offering some comfort for stretched consumers in coming months.

However, there are still upside risks which could drive prices higher – an eventuality which would leave the fiscally-strained government scrambling to appease the electorate as it heads into an election year.

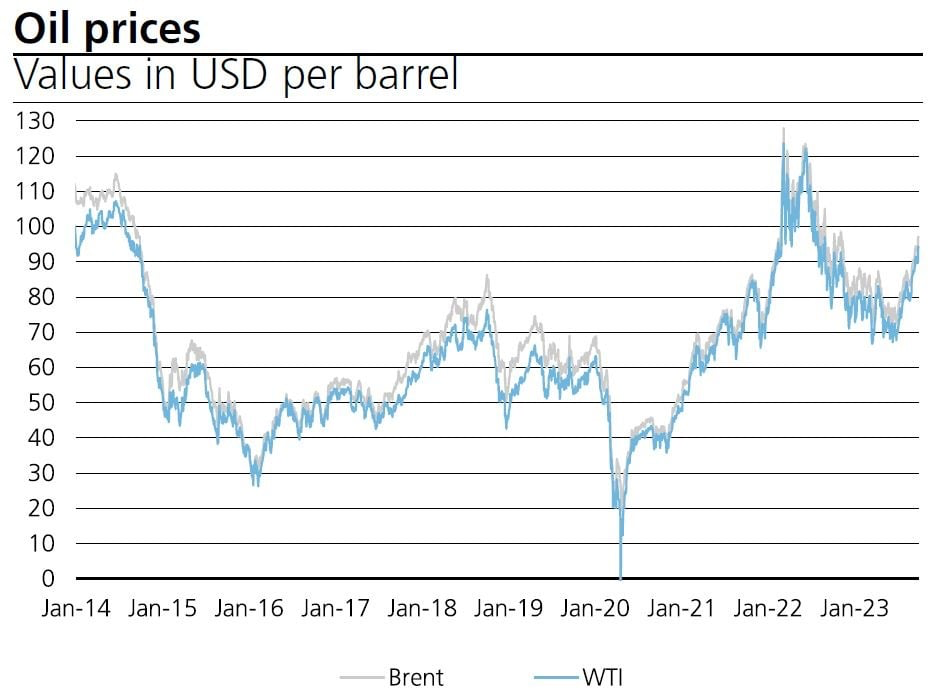

The price of Brent crude oil has this month breached $90 per barrel for the first time since October last year, and it is expected to bring with it a surge in fuel prices when they are adjusted next week.

Source: Bloomberg Finance, UBS

As of mid-September, estimates were that diesel prices could be hiked by as much as R2 a litre, while petrol prices could increase by as much as R1.23 a litre – pushing fuel prices to levels last seen in July last year. These forecasts have since moderated to R1.66 and R0.88, respectively, as oil traded at around $93 per barrel on Friday.

Fuel prices are among those critical factors which would keep interest rates from coming down, or even push them higher.

UBS Global Wealth Management analysts don't expect that oil will move past $100 a barrel on a sustained basis over the next 12 months. They do, however, believe strong fundamentals will support Brent within a range of $90 to $100 over the coming months.

"We believe oil can sustain its rally, which has taken Brent roughly 30% higher since the recent low in late June… we retain our year-end target of $95 per barrel," said Mark Haefele, Chief Investment Officer at UBS Global Wealth Management.

This, he said, is because top producers have extended supply cuts and global inventories are falling; meanwhile, demand remains solid and financial investors are adding exposure to oil, providing additional support for prices.

Matt Carusi, energy analyst at ESAI Energy, also does not expect crude prices to rise above $100 per barrel in the coming months. Already, the end of the summer holiday season, or driving season, in the Northern Hemisphere, is causing gasoline prices to taper off, he said.

Azar Jammine, director and chief economist at Econometrix, said the consensus view is for crude prices to fall to between $80 and $85 a barrel.

Jammine said there are many political factors in the mix, especially with regard to major oil producers Russia and Saudi Arabia, which have been cutting their oil output - triggering the price increases.

"The Russians, obviously, are being sanctioned, and therefore, are quite happy to disrupt the market to some extent, to create shortages in order to push the price up. So that whatever they can sell, they can get a slightly better price for it," he said. "The Saudis, and some of their other neighbouring countries, are very much involved in huge infrastructural investment schemes and are afraid that if oil prices are not high enough, they won't be able to fund their budget. And so they have been inclined to restrict output as much as possible lately, and that has pushed up oil prices."

Currently, there are indications that the Chinese economy is holding up better than expected, providing further potential support for oil prices.

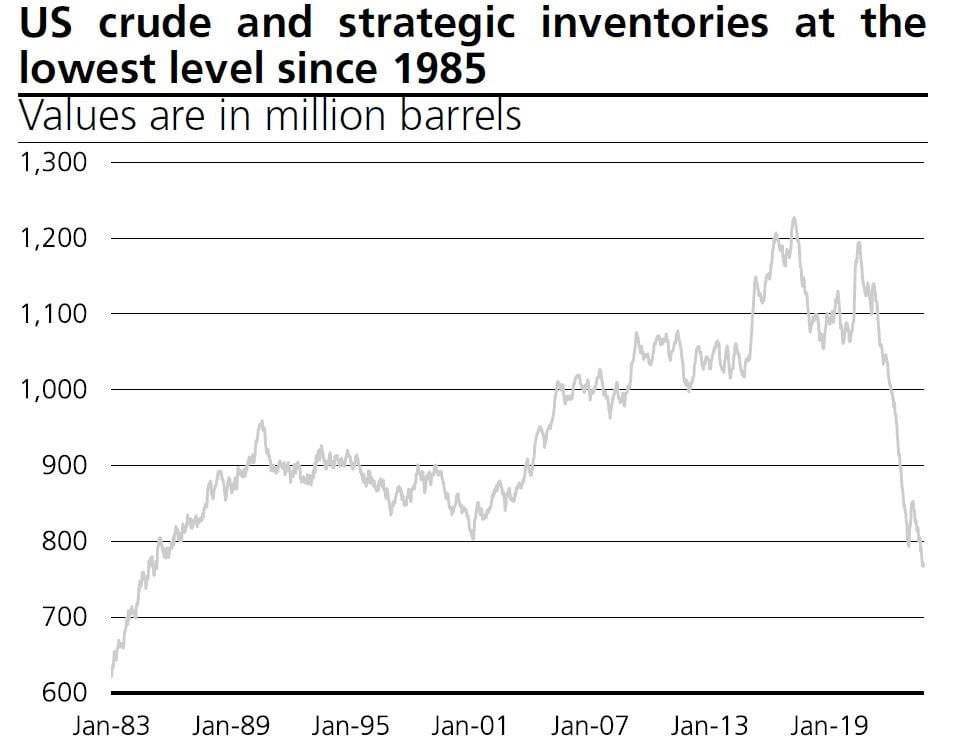

Also, there are concerns about alarmingly low commercial oil inventories in the US, which are at the lowest level since last December. Including the US government's strategic oil stocks, inventories have now hit a 1985 low.

Source: Energy Information Administration, UBS

While the consensus forecasts are for oil prices to soften, there is, of course, no guarantee that will indeed be the case, Jammine noted. "Should there be any further, unforeseen, major global conflagration, you could see prices spiking significantly upwards once again."

Saudi Arabia has been able to sustain upward pressure on prices partly because the US economy is doing relatively well now, at least compared to expectations. "If the American economy were to take a sharp turn for the worse, there'd be a lot of pressure on the Saudis to [increase] oil supplies to bring down the price of oil to make things easier for US consumers."

Diesel drama

Another factor to consider is diesel supply constraints, a relatively new phenomenon that continues to rear its head, with another supply crunch expected in the coming months.

Not only is a great deal of refinery maintenance slotted in for this autumn (in the Northern Hemisphere), but heating oil demand is also expected to rise during these months. Additionally, European refineries will continue to struggle with production because they are having a tough time accessing medium sour crudes following the import ban from Russia, Carusi said. Consequently, their refinery runs will be lower, which means that they will be producing less diesel and require more imports.

"This is being exacerbated by Russia's reduced ability to export diesel because of refinery maintenance, recent (temporary) restrictions on exporting low sulphur diesel, and increased levels of scrutiny now that Russian diesel prices have reached the G7's $100 cap," Carusi said, referring to a price cap the coalition of nations placed on diesel purchased from Russia in order to put pressure on the Kremlin's revenues amid a war on Ukraine.

"The latter development means that anyone who wants to ship this fuel will now be ineligible to access Western insurance services," he said. "Because most shippers don't want to confront the reputational risk of being in violation of the G7's price cap, we forecast that it would cause Russian diesel exports to be about 125 000 barrels per day lower in the fourth quarter of 2023 and the first quarter of 2024 than at the start of this year."

The coming jump in fuel prices next month alone is expected to kick South Africa's inflation rate back upwards quite sharply. But will that be enough for the South African Reserve Bank to raise interest rates? Not necessarily, Jammine noted.

"I think the Reserve Bank is hoping that this sudden increase proves to be temporary," he said. "But if it turns out to be far more sustained, and oil prices go up to $100 a barrel or more, and the rand remains as weak as it is, then I think we could be staring at further interest rate hikes. It's uncertain, but you don't want to rule that possibility out."

Powerless

Should oil prices continue to rise, South Africa is powerless to do much about it. A cut in the fuel levy in April and May last year would appear to have been a once-off as it was funded through the sale of the government's strategic oil stocks, of which there are no more.

However, the government can do something about the value of the rand, Jammine noted.

In light of various commitments, ranging from social relief of distress grants to national health insurance, "there are concerns about a major fiscal crisis if we're not careful, especially given that the price of coal, palladium, and rhodium have fallen very steeply. And so the key source of additional government revenue on which the government relies last year and the year before… has fallen away," Jammine said.

On top of that, there is the perilous situation of several critical state-owned entities for which there is no money to bail out. This has further stoked rand weakness.

But the government can exert some influence here, Jammine said.

"If the government, for example, readily agreed to privatize a lot of activities, suddenly, the Rand would rally, and the pressure on fuel prices, notwithstanding the increase in oil prices, would experience some kind of relief," he noted.

Article Source: News24